The Best Way to Budget for Couples

Buy your Kobold boyfriend a bubble tea and read this together.

A Hybrid Model for Budgeting for Couples

Ever dream of having a loving relationship, but remaining financially independent? Well, you’re in the right place. In this article, I will teach you my recommended method for managing your finances with your loved one, without completely mixing the peas and carrots. This is not as uncommon as it used to be, as more couples enter relationships with their own burdens of debts, portfolio of assets, or financial baggage.

Combining finances is totally fine if you decide to go that route, and a lot easier in many ways. However, there is no perfect way to manage your finances as a couple. I will introduce you to a basic method for managing money with a loved one, but you will need to tweak it and make it your own beautiful budget baby.

As a disclaimer, I share some images from YNAB (the budgeting app I use.) This is not an ad for them, I just think it will make your life easier.

The Account Structure

This article is focused on successfully setting up a system to manage money with a partner while retaining autonomy over your discretionary funding. It assumes you both want your own separate checking and savings account, but will require a joint checking account for bills.

You will need to do some work to find the sum of your shared expenses. Rent, electricity, internet, etc. don’t forget about recurring, but non-monthly expenses like car registration if you share a car. you’ll want to average that for the year to include those items.

After counting your shared expenses, you will each contribute half to the shared account, which can be automated with a monthly transfer. Then you will have funds in your account for your shared expenses, which tend to be predictable.

Now my secret sauce is to open a joint credit card and set up autopay to pay off the full amount each month. This will save you many fights about money, while your date night earns rewards to pay for your next vacation.

This makes talking about money much easier. Now, when you receive the statement balance from your credit card you can both look it over and let autopay make the payment from your joint checking. If you reserve your credit card for joint purchases, then the process will be smooth. You’ll also just need to make sure that the credit card bill is less than your joint account balance, which is not too tricky.

Some things like rent and bills may have to come from the joint account if the merchant does not accept credit, but that’s okay. The point of this system is to automate the bickering around money out of your relationship while maintaining a high level of financial independence. It’s the best of both worlds.

The secret sauce is to use the credit card to earn points, and pay it off from the joint checking. Viola, your next date night is on me…

What if Someone Makes More?

Okay, one of you makes more than the other… Unless you work the same job, for the same pay, and the same exact hours. If this is the case you should be figuring out who is real and who is the clone instead of reading this.

You will need to have a conversation about whether you want a 50/50 split or to contribute based on your income. The latter will allow the lower earner to achieve more of their goals and enjoy some spending money.

Using the 50/30/20 rule (needs/fun/saving); I would encourage you to test and see what 50% of your incomes would get you. Is it enough to cover the bills without overextending the lower earner?

Whichever method you choose it’s important to remember that your partner is your biggest ally. So, support each other and streamline your shared budget. Money is one of the biggest causes of fights and breakups, so don’t be a statistic. You’re smarter than that.

What Exactly is a Shared Expense?

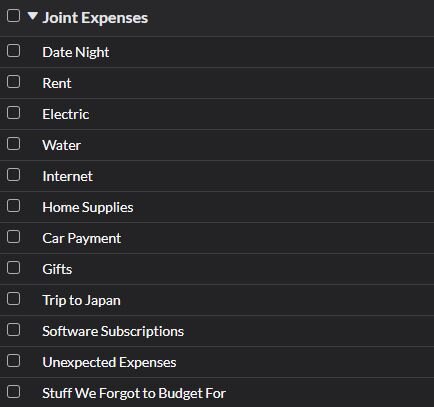

This is the nitty-gritty of budgeting. Some things are more predictable. Things like rent, electricity, water, internet. You know the recurring expenses. So, add all the obvious ones to your monthly donation to the shared account, but then add a little extra. You should also put a shared dream in there, otherwise, what’s it all for?

One thing that cannot be overstated is including your shared true expenses. So, important I bolded it. This is stuff that happens once a year or unexpectedly, like taking your pug to the vet. He’s the cutest dog on the planet, but he loves to have an emergency.

Add a little extra for those expenses and create a category for unexpected expenses.

Hot tip: Let your priorities guide your budget.

Is it too complicated?

No, not really. You can automate most of this. Most of the thinking is done upfront, but you save years of your life by asking each other for money for xyz bill. Yes, it is more complicated than sharing finances completely, but I have a feeling you wouldn't have made it to the end of this article if that was your persuasion.